TOPIC 1: THE THEORY OF DEMAND | COMMERCE FORM 2

Theory of Demand

Demand is willingness (desire) and the ability to buy a certain quantity of a

commodity at the going price at a specific period of time.

Condition for effective Demand

- Willingness to buy

- Ability to buy

- Specific period of time

- Given price level

- Community

Demand Schedule and Curves

Draw demand schedule and curves

particular good. It is used to highlight the law of demand. It can also

be used to derive a demand curve.

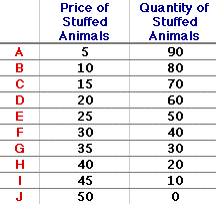

table in this exhibit displays the Shady Valley demand schedule for

stuffed Yellow Tarantulas, a cute and cuddly stuffed creature from the

Wacky Willy Stuffed Amigos line of collectibles.

This

table contains three columns. The first contains reference labels A, B,

C, etc. for each price-quantity pair. The second is the demand price,

ranging from $5 to $50. And the third is the quantity demanded, ranging

from 0 to 90 Yellow Tarantulas. This schedule assumes other ceteris

paribus factors remain unchanged and that the quantities are those

demanded during a one year time period

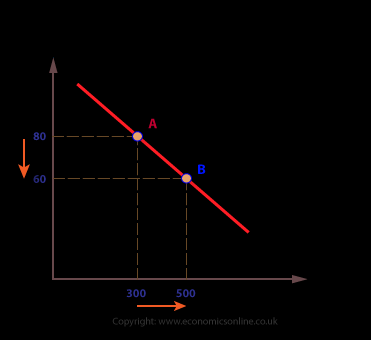

Demand curve, in economics, a graphic representation of the relationship between product price and the quantity of the product demanded. It is drawn with price

on the vertical axis of the graph and quantity demanded on the

horizontal axis. With few exceptions, the demand curve is delineated as

sloping downward from left to right because price and quantity demanded

are inversely related (i.e., the lower the price of a product, the

higher the demand or number of sales).

This relationship is contingent

on certain ceteris paribus (other things equal) conditions

remaining constant. Such conditions include the number of consumers in

the market, consumer tastes or preferences, prices of substitute goods,

consumer price expectations, and personal income.

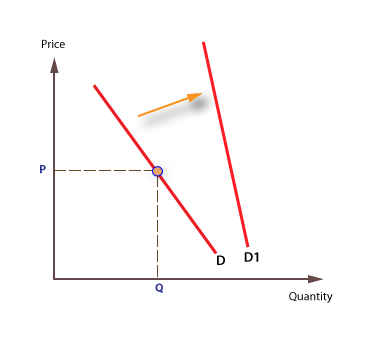

A change in one or

more of these conditions causes a change in demand, which is reflected

by a shift in the location of the demand curve. A shift to the left

indicates a decrease in demand

THE LAW OF DEMAND

law of demand is amicroeconomic law that states, all other factors

being equal, as the price of a good or service increases, consumer

demand for the good or service will decrease, and vice versa.

demand says that the higher the price, the lower the quantity demanded,

because consumers’ opportunity cost to acquire that good or service

increases, and they must make more tradeoffs to acquire the more

expensive product.

ASSUMPTIONS OF THE LAW OF DEMAND

No change in habits, customs and income of consumers:

Law of demand tells us that demand goes with a fall in price and goes

down with a rise in price. But an increase in price will not bring down

the demand if at the same time the income of the buyer has also

increased.

This law does not apply on necessaries of life:

It is assumed that this law is not applicable in the case of

necessaries of life. Because, an increase in the price of flour will not

bring down its demand. Likewise a fall in its price will not vary much

increase the demand for it.

Joint demand: Goods

which have joint demand also falsify the law. Thus, an increase in the

demand of cars will lead to more demand for petrol. Whereas the law of

demand states that the demand for petrol should increase on it its price

falls.

Articles of distinction: Law of demand

does not hold goods in case of those goods which confer social

distinction. When the price of such goods goes up, their demand shall

also increase. For instance, an increase in the price of diamond will

raise its demand and a fall in price will lower the demand.

Fear of shortage in future:

If there is a fear of shortage of a good in future its demand will

increase in present as people would start storing. But according to law

of demand its demand should go it when its price falls.

Change in the price of substitutes:

This law does not apply in the case of tea and coffee, because these

goods are substitutes of each other. When the price of coffee goes up

the demand for tea shall increase although there has been no fall in the

price of tea.

Fear of a rise in price in future:

If consumers think that the price of particular goods will increase in

future, they will store it. In other words, the demand of those goods

shall increase at the same price. But this law states that demand should

go up only if price falls.

Ignorance: It is

possible that a consumer may not be aware of the previous price of a

good. In this case consumer might start purchasing more of a commodity

when its price has actually gone up. A new approach called the ordinal

utility approach, developed by Edgeworth, Pareto. Slutsky, Johnson,

Hicks and Allen are easier and more helpful in solving the problem of

consumer’s demand. The ordinal theory not only requires fewer

assumptions but possesses greater predictive power than does its

cardinal cousin.

because utility is not cardinally measurable, but simply because such

measurement is not at all required for analyzing consumer’s behaviour.

The points of distinction between the cardinal and the ordinal measures

of utility.

The law of demand does not apply in every case and situation. The circumstances when the law of demand becomes ineffective are known as exceptions of the law. Some of these important exceptions are as under.

Giffen goods:

Some special varieties of inferior goods are termed as Giffen goods.

Cheaper varieties of this category like bajra, cheaper vegetable like

potato come under this category. Sir Robert Giffen or Ireland first

observed that people used to spend more their income on inferior goods

like potato and less of their income on meat. But potatoes constitute

their staple food. When the price of potato increased, after purchasing

potato they did not have so many surpluses to buy meat. So the rise in

price of potato compelled people to buy more potato and thus raised the

demand for potato. This is against the law of demand. This is also known

as Giffen paradox.

Conspicuous Consumption:

This exception to the law of demand is associated with the doctrine

propounded by Thorsten Veblen. A few goods like diamonds etc are

purchased by the rich and wealthy sections of the society. The prices of

these goods are so high that they are beyond the reach of the common

man. The higher the price of the diamond the higher the prestige value

of it. So when price of these goods falls, the consumers think that the

prestige value of these goods comes down. So quantity demanded of these

goods falls with fall in their price. So the law of demand does not hold

good here.

Conspicuous necessities: Certain

things become the necessities of modern life. So we have to purchase

them despite their high price. The demand for T.V. sets, automobiles and

refrigerators etc. has not gone down in spite of the increase in their

price. These things have become the symbol of status. So they are

purchased despite their rising price. These can be termed as “U” sector

goods.

Ignorance: A consumer’s ignorance is

another factor that at times induces him to purchase more of the

commodity at a higher price. This is especially so when the consumer is

haunted by the phobia that a high-priced commodity is better in quality

than a low-priced one.

Emergencies: Emergencies

like war, famine etc. negate the operation of the law of demand. At

such times, households behave in an abnormal way. Households accentuate

scarcities and induce further price rises by making increased purchases

even at higher prices during such periods. During depression, on the

other hand, no fall in price is a sufficient inducement for consumers to

demand more.

Future changes in prices:

Households also act speculators. When the prices are rising households

tend to purchase large quantities of the commodity out of the

apprehension that prices may still go up. When prices are expected to

fall further, they wait to buy goods in future at still lower prices. So

quantity demanded falls when prices are falling.

Change in fashion:

A change in fashion and tastes affects the market for a commodity. When

a broad toe shoe replaces a narrow toe, no amount of reduction in the

price of the latter is sufficient to clear the stocks. Broad toe on the

other hand, will have more customers even though its price may be going

up. The law of demand becomes ineffective.

The following are the factors which determine demand for goods:

Tastes and Preferences of the Consumers:

An important factor which determines demand for a good is the tastes

and preferences of the consumers for it. A good for which consumers’

tastes and preferences are greater, its demand would be large and its

demand curve will lie at a higher level. People’s tastes and preferences

for various goods often change and as a result there is change in

demand for them. The changes in demand for various goods occur due to

the changes in fashion and also due to the pressure of advertisements by

the manufacturers and sellers of different products. For example, a

few years back when Coca Cola plant was established in New Delhi demand

for it was very small. But now people’s taste for Coca Cola has

undergone a change and become favourable to it because of large

advertisement and publicity done for it. The result of this is that the

demand for Coca-Cola has increased very much. In economics we would say

that the demand curve For Coca Cola has shifted upward. On the contrary

when any good goes out of fashion or people’s tastes and preferences no

longer remain favourable to it the demand for it decreases. In economics

we say that the demand curve for these goods will shift downward.

Incomes of the People:

The demand for goods also depends upon incomes of the people. The

greater the incomes of the people the greater will be their demand for

goods. In drawing a demand schedule or a demand curve for a good we take

incomes of the people as given and constant. When as a result of the

rise in incomes of the people, the demand increases, the whole of the

demand curve shifts upward and vice versa. The greater income means the

greater purchasing power. Therefore, when incomes of the people

increase, they can afford to buy more. It is because of this reason that

the increase in income has a positive effect on the demand for a good.

When the incomes of the people fall they would demand less of the goods

and as a result the demand curve will shift below. For instance, during

the planning period in India the incomes of the people have greatly

increased owing to the large investment expenditure on the development

schemes by the Government and the private sector. As a result of this

increase in incomes, demand for food-grains has greatly increased which

has resulted in rightward shift in the demand curve for them. Likewise,

when because of drought in a year the agricultural production greatly

falls, incomes of the farmers decline. As a result of the decline in

incomes of the farmers, they demand less of cotton cloth and other

manufactured products.

Changes in the Prices of the Related Goods:

The demand for a good is also affected by the prices of other goods,

especially those which are related to it as substitutes or complements.

When we draw a demand schedule or a demand curve for a good we take the

prices of the related goods as remaining constant. Therefore, when the

prices of the related goods, substitutes or complements, change the

whole demand curve would change its position; it will shift upward or

downward as the case may be. When price of a substitute for a good

falls, the demand for that good will decline and when the price of the

substitute rises, the demand for that good will increase. For example,

when price of the tea as well as the incomes of the people remains the

same but price of the coffee falls, the consumers would demand less of

tea than before. Tea and coffee are very close substitutes, therefore

when coffee becomes cheaper, the consumers substitute coffee for tea and

as a result the demand for tea declines. The goods which are

complementary with each other, the change in the price of any of them

would affect the demand of the other. For instance, if price of the milk

falls, the demand for sugar would also be affected. When people would

take more milk or would prepare more khoya, burfi, rasgullas with milk;

the demand for sugar will also increase. Likewise, when price of cars

falls, the demand for them will increase which in turn will increase the

demand for petrol Cars and petrol are complementary with each other.

The Number of Consumers in the Market:

We have already explained that the market demand for a good is obtained

by adding up the individual demands of the present as well as

prospective consumers or buyers of a good at various possible prices.

The greater the number of consumers of a good, the greater the market

demand for it. Now, the question arises on what factors the number of

consumers of a good depends. If the consumers substitute one good for

another, then the number of consumers of that good which has been

substituted by the other will decline and for the good which has been

used in its place, the number of consumers will increase. Besides, when

the seller of a good succeeds in finding out new markets for his good

and as a result the market for his good expands the number of consumers

of that good will increase. Another Important cause for the increase in

the number of consumers is the growth in population. For instance, in

India the demand for many essential goods, especially food-grains, has

increased because of the increase in the population of the country and

the resultant increase in the number of consumers for them.

Changes in Propensity to Consume:

People’s propensity to consume also affects the demand for them. The

income of the people remaining constant, if their propensity to consume

rises, then out of the given income they would spend a greater part of

it with the result that the demand for goods will increase. On the other

hand, if propensity to save of the people increases, that is, if

propensity to consume declines, then the consumers would spend a smaller

part of their income on goods with the result that the demand for goods

will decrease. It is thus clear that with income remaining constant,

change in propensity to consume of the people will bring about a change

in the demand for goods.

Consumers’ Expectations with regard to Future Prices:

Another factor which influences the demand for goods is consumers’

expectations with regard to future prices of the goods. If due to some

reason, consumers expect that in the near future prices of the goods

would rise, then in the present they would demand greater quantities of

the goods so that in the future they should not have to pay higher

prices. Similarly, when the consumers hope that in the future they will

have good income, then in the present they will spend greater part of

their incomes with the result that their present demand for goods will

increase.

Income Distribution: Distribution of

income in a society also affects the demand for goods. If distribution

of income is more equal, then the propensity to consume of the society

as a whole will be relatively high which means greater demand for goods.

On the other hand, if distribution of income is more unequal, then

propensity to consume of the society will be relatively less, for the

propensity to consume of the rich people is less than that of the poor

people. Consequently with more unequal distribution of income, the

demand for consumer goods will be comparatively less. This is the effect

of the income distribution on the propensity to consume and demand for

goods. But the change in the distribution of income in the society would

affect the demand for various goods differently. If progressive taxes

are levied on the rich people and the money so collected is spent on

providing employment to the poor people, the distribution of income

would become more equal and with this there would be a transfer of

purchasing power from the rich to the poor. As a result of this, the

demand for those goods will increase which are generally purchased by

the poor because the purchasing power of the poor people has increased

and, on the other hand, the demand for those goods will decline which

are usually consumed by the rich on whom progressive taxes have been

levied.

FACTORS FOR CHANGE IN DEMAND

Tastes and preferences of the consumer:

Tastes include fashion, habit, customs etc. A good for which consumers

tastes and preferences are greater claim higher demand. Thus the demand

curve lies at a higher level. With the change in consumer’s taste and

preference for particular commodity the demand for that commodity

declines. If the taste goes up its amount demanded becomes high even at a

high price. Those goods which go out of fashion of people no longer

remains attractive to them. So the demand for them decreases.

Income of the people:

The demand for goods depends upon the income of the people. There is

direct relation between income and demand for immodesties. A rise in

income gives rise to greater purchasing power. Thus increase in income

has a positive effect for a good. With a rise and fall in income the

demand curve shifts upward and downward respectively. But in case of

giffen goods the income effect is negative.

Changes in prices of the related goods:

The demand for a commodity is affected by the changes in the prices of

other related commodities. The related commodities may be (i) substitute

and (ii) complementary. A commodity is said to be substitute only when

it yields the same utility and satisfaction in place of other.

Complementary goods are jointly demanded. They are consumed untidily for

satisfaction. Tea and coffee are substitute’s goods but pen and ink are

complementary commodities. When the price of a substitute of a good

falls the demand for that good declines and when the price of the

substitute rises, the demand for that good increases. In case of

complementary goods there is opposite relationship between price of one

commodity and the amount demanded for the other. The effect in change in

price of related goods on the amount demanded is called as Gross

Demand.

Future expectation: Present demand for a

commodity also depends on the future expectation of the change in

price. If people expect that the price of a commodity will rise in

future, they will buy more even at a high price so as to escape the

further rise in price in future. Similarly any expectation of the fall

in price in future will diminute demand for a commodity as people expect

further fall in price. Similarly if buyers expect their incomes to rise

in future, they may increase the present demand.

Population:

Rise of population also gives rise to demand for necessaries of life.

The composition and size of population affect the demand. With high

birth rate demand for milk food, medicines and garments increase. The

rise in the proportion of adult, old and woman also shape the nature of

demand accordingly.

Income distribution: Income

distribution in the society affects the demand for goods. If the

distribution of income is even then the demand for goods is greater. On

the other hand if the distribution of income is unequal, the demand for

consumer goods will be comparatively less.

Elasticity of Demand

Define elasticity of demand

degree to which demand for a good or service varies with its price.

Normally, sales increase with drop in prices and decrease with rise in

prices. As a general rule, appliances, cars, confectionary and other

non-essentials show elasticity of demand whereas most necessities (food,

medicine, basic clothing) show inelasticity of demand (do not sell

significantly more or less with changes in price).

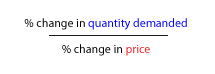

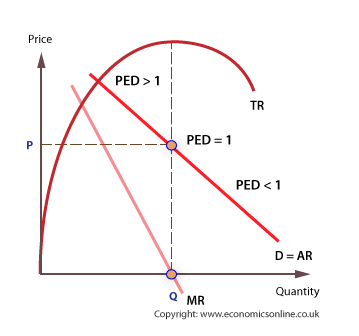

Price

elasticity of demand (PED) shows the relationship between price and

quantity demanded and provides a precise calculation of the effect of a

change in price on quantity demanded.

We can use this equation to calculate the effect of price changes on

quantity demanded, and on the revenue received by firms before and after

any price change.

the price of envelopes was $3 a box, and Julie was willing to buy 10

boxes. Today, the price has gone up to $3.75 a box, and Julie is now

willing to buy 8 boxes. Is Julie’s demand for envelopes elastic or

inelastic? What is Julie’s elasticity of demand?

To

find Julie’s elasticity of demand, we need to divide the percent change

in quantity by the percent change in price. <!– [if

!supportLineBreakNewLine]–> <!–[endif]–>

- % Change in Quantity = (8 – 10)/(10) = -0.20 = -20%

- %Change in Price = (3.75 – 3.00)/(3.00) = 0.25 = 25%

- Elasticity = |(-20%)/(25%)| = |-0.8| = 0.8

Her

elasticity of demand is the absolute value of -0.8, or 0.8. Julie’s

elasticity of demand is inelastic, since it is less than 1.

Neil’s elasticity of demand for hot dogs is constantly 0.9, and he buys

4 hot dogs when the price is $1.50 per hot dog, how many will he buy

when the price is $1.00 per hot dog?

This

time, we are using elasticity to find quantity, instead of the other

way around. We will use the same formula, plug in what we know, and

solve from there. <!– [if !supportLineBreakNewLine]–>

<!–[endif]–>

Elasticity =

And, in the case of John, %Change in Quantity = (X – 4)/4

Therefore :

Elasticity = 0.9 = |((X – 4)/4)/(% Change in Price)|

% Change in Price = (1.00 – 1.50)/(1.50) = -33%

0.9 = |(X – 4)/4)/(-33%)|

|((X – 4)/4)| = 0.3

0.3 = (X – 4)/4

X = 5.2 <!– [if !supportLineBreakNewLine]–> <!–[endif]–>

Since

Neil probably can’t buy fractions of hot dogs, it looks like he will

buy 5 hot dogs when the price drops to $1.00 per hot dog.

Problem : Which

of the following goods are likely to have elastic demand, and which are

likely to have inelastic demand? <!– [if

!supportLineBreakNewLine]–> <!–[endif]–>

- Home heating oil

- Pepsi

- Chocolate

- Water

- Heart medication

- Oriental rugs

- Elastic demand: Pepsi, chocolate, and Oriental rugs

- Inelastic demand: Home heating oil, water, and heart medication

Problem: If supply is unit elastic and demand is inelastic, a shift in which curve would affect quantity more? Price more?

advertises to sell cookies for $4 a dozen. She sells 50 dozen, and

decides that she can charge more. She raises the price to $6 a dozen and

sells 40 dozen. What is the elasticity of demand? Assuming that the

elasticity of demand is constant, how many would she sell if the price

were $10 a box?

To

find the elasticity of demand, we need to divide the percent change in

quantity by the percent change in price. <!– [if

!supportLineBreakNewLine]–> <!–[endif]–>

- % Change in Quantity = (40 – 50)/(50) = -0.20 = -20%

- % Change in Price = (6.00 – 4.00)/(4.00) = 0.50 = 50%

- Elasticity = |(-20%)/(50%)| = |-0.4| = 0.4 <!– [if !supportLineBreakNewLine]–> <!–[endif]–>

find the quantity when the price is $10 a box, we use the same formula:

<!– [if !supportLineBreakNewLine]–> <!–[endif]–>

- Elasticity = 0.4 = |(% Change in Quantity)/(% Change in Price)|

- % Change in Price = (10.00 – 4.00)/(4.00) = 1.5 = 150% <!– [if !supportLineBreakNewLine]–> <!–[endif]–>

that before taking the absolute value, elasticity was -0.4, so use -0.4

to calculate the changes in quantity, or you will end up with a big

increase in consumption, instead of a decrease! <!– [if

!supportLineBreakNewLine]–> <!–[endif]–>

- -0.4 = |(% Change in Quantity)/(150%)|

- |(%Change in Quantity)| = -60% =

- -0.6 -0.6 = (X – 50)/50

- X = 20 <!– [if !supportLineBreakNewLine]–> <!–[endif]–>

example, if the price of a daily newspaper increases from £1.00 to

£1.20p, and the daily sales fall from 500,000 to 250,000, the PED will

be:

- – 50%/ + 20%

- = (-) 2.5

The

negative sign indicates that P and Q are inversely related, which we

would expect for most price/demand relationships. This is significant

because the newspaper supplier can calculate or estimate how revenue

will be affected by the change in price. In this case, revenue at £1.00

is £500,000 (£1 x 500,000) but falls to £300,000 after the price rise

(£1.20 x 250,000).

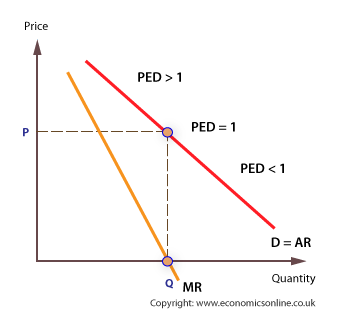

The

degree of response of quantity demanded to a change in price can vary

considerably. The key benchmark for measuring elasticity is whether the

co-efficient is greater or less than proportionate. If quantity demanded

changes proportionately, then the value of PED is 1, which is called

‘unit elasticity’.

- Less than one, which means PED is inelastic.

- Greater than one, which is elastic.

- Zero (0), which is perfectly inelastic.

- Infinite (∞), which is perfectly elastic.

on a linear demand curve will fall continuously as the curve slopes

downwards, moving from left to right. PED = 1 at the midpoint of a

linear demand curve.

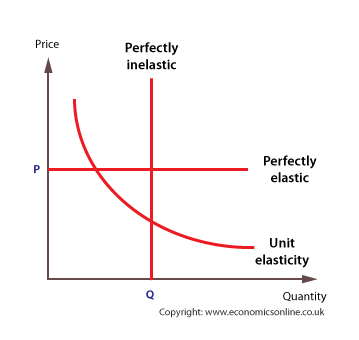

- Perfectly elastic demand

- Perfectly inelastic demand

- Relatively elastic demand

- Relatively inelastic demand

- Unitary elastic demand

Perfectly elastic demand:

The demand is said to be perfectly .elastic when a very insignificant

change in price leads to an infinite change in quantity demanded. A very

small fall in price causes demand to rise infinitely. Likewise a very

insignificant rise in price reduces the demand to zero. This case is

theoretical which is never found in real life.

Perfectly inelastic demand:

The demand is said to be perfectly inelastic when a change in price

produces no change in the quantity demanded of a commodity. In such a

case quantity demanded remains constant regardless of change in price.

The amount demanded is totally unresponsive of change in price. The

elasticity of demand is said to be zero.

Relatively more elastic demand:

The demand is relatively more elastic when a small change in price

causes a greater change in quantity demanded. In such a case a

proportionate change in price of a commodity causes more than

proportionate change in quantity demanded. If price changes by 10% the

quantity demanded of the commodity change by more than 10% i.e. 25%. The

demand curve in such a situation is relatively flatter.

Relatively inelastic demand:

It is a situation where a greater change in price leads to smaller

change in quantity demanded. The demand is said to be relatively

inelastic when a proportionate change in price is greater than the

proportionate change in quantity demanded. For example If price falls by

20% quantity demanded rises by less than 20% i.e 15%.

Unitary elastic demand:

The demand is said to be unit when a change in price produces exactly

the same percentage change in the quantity demanded of a commodity. In

such a situation the percentage change in both the price and quantity

demanded is the same. For example if the price falls by 25% the quantity

demanded rises by the same 25%. It takes the shape of a rectangular

hyperbola. Numerically elasticity of demand is said to be equal to 1.(ed

= 1).

- Total revenue (TR), which is found by multiplying price by quantity sold (P x Q).

- <!–[endif]–>Average

revenue (AR), which is found by dividing total revenue by quantity sold

(TR/Q). Consider these figures and calculate Total, Marginal and

Average Revenue. - <!–[endif]–>Marginal revenue (MR),

which is defined as the revenue from selling one extra unit. This is

calculated by finding the change in TR from selling one more unit.

| PRICE (£) | Qd | TR | MR | AR |

| 10 | 1 | – | – | – |

| 9 | 2 | – | – | – |

| 8 | 3 | – | – | – |

| 7 | 4 | – | – | – |

| 6 | 5 | – | – | — |

| 5 | 6 | – | – | – |

| 4 | 7 | – | – | – |

| 3 | 8 | – | – | – |

| 2 | 9 | – | – | — |

| 1 | 10 | – | – | – |

the patterns of numbers and see if you can analyse the relationships

between the three measures of revenue – then answer the following:

- How are price and average revenue connected?

- What happens to total revenue as output increases?

- What is the connection between total revenue and marginal revenue?

- How are marginal revenue and average revenue connected?

- Price and AR are identical, because AR = TR/Q, which is P x Q/Q, and cancel out the Qs to get P.

- A curve plotting AR (=P) against Q is also a firm’s demand curve.

- TR increases, reaches a peak and decreases.

Why does a firm want to know PED?

There

are several reasons why firms gather information about the PED of its

products. A firm will know much more about its internal operations and

product costs than it will about its external environment. Therefore,

gathering data on how consumers respond to changes in price can help

reduce risk and uncertainly. More specifically, knowledge of PED can

help the firm forecast its sales and set its price.

- Sales forecasting;

The firm can forecast the impact of a change in price on its sales

volume, and sales revenue (total revenue, TR). For example, if PED for a

product is (-) 2, a 10% reduction in price (say, from £10 to £9) will

lead to a 20% increase in sales (say from 1000 to 1200). In this case,

revenue will rise from £10,000 to £10,800.

- Pricing policy;

Knowing PED helps the firm decide whether to raise or lower price, or

whether to price discriminate. Price discrimination is a policy of

charging consumers different prices for the same product. If demand is

elastic, revenue is gained by reducing price, but if demand is

inelastic, revenue is gained by raising price.

- Non-pricing policy; When PED is highly elastic, the firm can use advertising and other promotional techniques to reduce elasticity.

The number and ‘closeness’ of substitutes. A unique and desirable product is likely to exhibit an inelastic demand with respect to price.

The degree of necessity of the good. A necessity like bread will be demanded in elastically with respect to price.

Whether the good is habit forming. Consumers are also relatively insensitive to changes in the price of habitually demanded products.

The proportion of consumer income which is spent on the good The PED for a daily newspaper is likely to be much lower than that for a new car!

Whether consumers are loyal to the brand Brand. loyalty reduces sensitivity to price changes and reduces PED.

Life cycle of product PED will vary according to where the product is in its life cycle.

When new products are launched, there are often very few competitors

and PED is relatively inelastic. As other firms launch similar products,

the wider choice increases PED. Finally, as a product begins to decline

in its lifecycle, consumers can become very responsive to price, hence

discounting is extremely common.

use a range of media, including television, press, and electronic

media. Advertising will shift demand to the right, and make demand less

elastic.

- Perfectly elastic, where only one price can be charged.

- Perfectly inelastic, where only one quantity will be purchased.

- Unit elasticity,

where all the possible price and quantity combinations are of the same

value. The resultant curve is called a rectangular hyperbola.

Factors that Determine Degree of Elasticity (Changes) of Demand

Identify the factors that determine degree of elasticity (changes) of demand

Various factors which affect the elasticity of demand of a commodity are:

Nature of commodity:

Elasticity of demand of a commodity is influenced by its nature. A

commodity for a person may be a necessity, a comfort or a luxury.

i. When a commodity is a necessity like food grains, vegetables, medicines,

etc., its demand is generally inelastic as it is required for human

survival and its demand does not fluctuate much with change in price.

ii. When a commodity is a comfort like fan, refrigerator, etc., its

demand is generally elastic as consumer can postpone its consumption.

iii. When a commodity is a luxury like AC, DVD player, etc., its demand

is generally more elastic as compared to demand for comforts.

iv. The term ‘luxury’ is a relative term as any item (like AC), may be a luxury

for a poor person but a necessity for a rich person.

Availability of substitutes:

Demand for a commodity with large number of substitutes will be more

elastic. The reason is that even a small rise in its prices will induce

the buyers to go for its substitutes. For example, a rise in the price

of Pepsi encourages buyers to buy Coke and vice-versa. Thus,

availability of close substitutes makes the demand sensitive to change

in the prices. On the other hand, commodities with few or no substitutes

like wheat and salt have less price elasticity of demand.

Income Level:

Elasticity of demand for any commodity is generally less for higher

income level groups in comparison to people with low incomes. It happens

because rich people are not influenced much by changes in the price of

goods. But, poor people are highly affected by increase or decrease in

the price of goods. As a result, demand for lower income group is highly

elastic.

Level of price: Level of price also affects the price elasticity of demand. Costly goods like laptop, Plasma TV, etc. have highly elastic demand as their demand is very sensitive

to changes in their prices. However, demand for inexpensive goods like

needle, match box, etc. is inelastic as change in prices of such goods

do not change their demand by a considerable amount.

Postponement of Consumption:

Commodities like biscuits, soft drinks, etc. whose demand is not

urgent, have highly elastic demand as their consumption can be postponed

in case of an increase in their prices. However, commodities with

urgent demand like life saving drugs, have inelastic demand because of

their immediate requirement.

Number of Uses:

If the commodity under consideration has several uses, then its demand

will be elastic. When price of such a commodity increases, then it is

generally put to only more urgent uses and, as a result, its demand

falls. When the prices fall, then it is used for satisfying even less

urgent needs and demand rises. For example, electricity is a

multiple-use commodity. Fall in its price will result in substantial

increase in its demand, particularly in those uses (like AC, Heat

convector, etc.), where it was not employed formerly due to its high

price. On the other hand, a commodity with no or few alternative uses

has less elastic demand.

Share in Total Expenditure:

Proportion of consumer’s income that is spent on a particular commodity

also influences the elasticity of demand for it. Greater the proportion

of income spent on the commodity, more is the elasticity of demand for

it and vice-versa. Demand for goods like salt, needle, soap, match box,

etc. tends to be inelastic as consumers spend a small proportion of

their income on such goods.

When prices of such goods change, consumers

continue to purchase almost the same quantity of these goods. However,

if the proportion of income spent on a commodity is large, then demand

for such a commodity will be elastic. 8. Time Period: Price elasticity

of demand is always related to a period of time.

It can be a day, a

week, a month, a year or a period of several years. Elasticity of demand

varies directly with the time period. Demand is generally inelastic in

the short period. It happens because consumers find it difficult to

change their habits, in the short period, in order to respond to a

change in the price of the given commodity.

However, demand is more

elastic in long rim as it is comparatively easier to shift to other

substitutes, if the price of the given commodity rises. 9. Habits:

Commodities, which have become habitual necessities for the consumers,

have less elastic demand.

It happens because such a commodity becomes a

necessity for the consumer and he continues to purchase it even if its

price rises. Alcohol, tobacco, cigarettes, etc. are some examples of

habit forming commodities.

Finally it can be concluded that elasticity

of demand for a commodity is affected by number of factors. However, it

is difficult to say, which particular factor or combination of factors

determines the elasticity. It all depends upon circumstances of each

case.

- State the law of law of demand and its assumption.

- Explain the factor that influencing the demand of a commodity.

Thanks-a-mundo for the post.Really thank you! Really Great.

Muchos Gracias for your blog post. Really Great.

Thanks-a-mundo for the article. Awesome.

Im grateful for the blog article.Much thanks again. Really Cool.

I cannot thank you enough for the article. Really thank you! Really Great.